private reit tax advantages

Types of Real Estate Investment Trust REIT In a broader sense the types of business REITs are involved with tend to help classify them better. They are taxed at normal income tax ratesMany real estate investment trusts REITs for example pay out ordinary dividends which can raise your overall tax burdenThese are sometimes referred to as nonqualified dividends and are reported in.

All In One Guide To Important Budget 2021 22 Proposals

Ordinary DividendsDividends paid out from a companys earnings and profits are referred to as ordinary dividends.

. Skyline Retail Real Estate Investment Trust REIT is an income-producing opportunity to invest in a 100 Canadian diversified portfolio of retail properties with a focus. Advantages of Preference Shares to Issuing Company. Finite-Life REIT - FREIT.

K Raheja Corp Group is the sponsor of Mindspace REIT. The cost of raising capital from preference shares is less than equity shares. Certain non-cash deductions such as depreciation and amortization lower the taxable income for REIT distributions.

And such ratios should be viewed as indicators of internal or competitive advantages eg management asset management rather than being interpreted at face value without further inquiry. AXUN announced today that it has closed its previously announced offering of 200 million aggregate principal amount of series E senior unsecured debentures the Debentures. Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and government contracting professionals.

The Debentures bear interest at a rate of 560 per annum and mature on April 29 2025. If youre going to invest in a real estate investment trust REIT its typically a good idea to do so in a registered account. The company is not bound to pay dividend if its profits in a particular year are insufficient.

A distribution is not the same as a dividend since it may contain dividends capital gains a capital return interest or other income. Real estate funds are mutual funds that may invest in REITs. This type of REIT is among the most popular ones.

The tax advantages arent available after 15 years. An Investment anchored by retail services. Invest in a private real estate investment trust comprised of national tenants across Canada in secondary and tertiary markets.

Investors should be aware that a REITs ROC percentage may vary significantly in a given year and as a result the impact of the tax law and any related advantages may vary significantly from year to year. As with all financial ratios a closer look is necessary to understand the company-specific factors that can impact the ratio. Do housework in the private home of a farm operated for profit.

A real estate investment trust REIT that aims to sell its real estate holdings within a specified time frame so. The following is a list of the different types of REITs. Is a personal savings plan that allows you to set aside money for retirement while offering you tax advantages.

Artis Real Estate Investment Trust Artis or the REIT TSX. A real estate investment trust REIT invests in income-producing real estate and trades like stocks. By hewing to these rules REITs dont have to pay tax at the corporate level which allows them to finance real estate more cheaply than non-REIT companies can.

Murty holds a 091 stake in Bengalaru India-based Infosys according to the companys most recent annual report. With a total leasable area of 302 msf it has a solid portfolio of office spaces across Mumbai Pune Hyderabad and Chennai. Most countries laws on REITs entitle a.

The IRS will only issue an EIN for an IRA trust account if the individual intends to file Form 990-T Exempt Organization Business Income Tax Return or Form 1041 U. Also the methods devised to sell and purchase shares further help classify REITs. The payment from a REIT is referred to as a distribution rather than a dividend.

As per the Income Tax Act 1961 dividends earned from preference shares are tax free up to Rs 10 lakh. A real estate investment trust REIT is a company that owns and in most cases operates income-producing real estateREITs own many types of commercial real estate including office and apartment buildings warehouses hospitals shopping centers hotels and commercial forestsSome REITs engage in financing real estate.

New First Stop For Hacked Site Recovery Videos Googlewebmastercentral Tech Pinterest Seo Computer Security And Tech

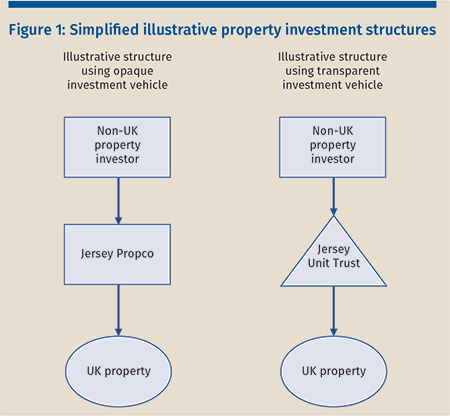

Property Investment Some Recent Developments

Restricted Stock Finance Investing Learn Accounting Bookkeeping Business

1 Real Estate Investment Trusts Reits 20 2 What Is It Securitized Real Estate Investment Ownership Form Created By Irs Code Ppt Download

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

Don T Find Residential Rental Yields Attractive Enough Opt For Reits Business Standard News

We Re Thrilled To Have Entertainment Financial As An Exhibitor For The 2012 Business Showcase Entertaining Allianz Logo Business

Your Wealth Secret An Automatic Systematic Accumulation And Investment Program Ezmart4u Investing Systematic Investment Plan Creating Wealth

Pin By Jessica Greene On Love Love Finance Investing Finance Investing

Tax Holiday Extension For Home Buyers Gives A Fillip To Affordable Housing

Are Real Estate Investment Trusts Reits A Good Investment Right Now The Pros And Cons Financial Freedom Countdown

Fone Fast Folks 1201 E Cesar Chavez St 78702 060917 Phone Pay Phone Commercial Real Estate

/GettyImages-903438576-00b7cdbed54443e3abe4c8144fb232b4.jpg)

Direct Participation Program Dpp

Property Tax Planning Andrew Crossman Bloomsbury Professional

Competitive Taxation And Tax Competition The Winner Takes It All Kluwer International Tax Blog

Tax Loss Harvesting How You Can Save On Taxes By Booking Losses Wealthzi

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

Restricted Stock Finance Investing Learn Accounting Bookkeeping Business